2nd Quarter, 2023

Good entry points come in periods of market uncertainty.

THE MARKETS

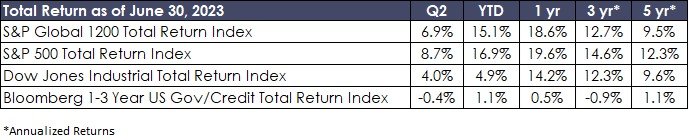

Markets forged ahead early in the second quarter led by a surge in stocks allied with the artificial intelligence (AI) theme. However, as the chart below shows, the strength was narrowly based and largely dependent on a handful of the largest market cap companies. As the quarter progressed, market sentiment on interest rates began to shift from the belief that hiking cycles soon would give way to cuts, to the acceptance that central banks’ resolve to tame inflation would lead rates to remain higher for longer. Global markets seem to be reflecting that 2% inflation targets are not in the cards until 2025 at the earliest. Talk that 3% is the new 2% is becoming more commonplace as inflation shows stickiness in spite of significant declines in energy and other physical commodities. Although inflation fighting rhetoric is much louder in Europe than in the US, both have recently said in near unison that this is the path to higher rates for longer.

Following the Federal Reserve’s “hawkish pause” in June and the bi-partisan debt and budget resolution, the market backdrop has taken a more subdued tone. The yield curve remains inverted, with 3 and 6-month Treasury bills holding at over 5%, the 2 year Treasury at 4.9%, and the 10 year Treasury just under 3.9%. Lower Federal tax receipts translate to an increase in the deficit. Although the Treasury is replenishing its coffers with much larger T-bill auctions, the market seems to be absorbing the supply. However, bank deposits have been moving to T-bills or money market funds, which creates a degree of disintermediation.

Valuations compressed in 2022, but this year’s market recovery has caused that to reverse. The S&P 500 now trades at roughly 20 times forward earnings estimates. As such, markets are vulnerable to renewed fears of inflation and recession. A continuation of narrow market breadth would also imply vulnerability.

Corporate profits ex-finance have been resilient. However, disappointments in specific company earnings and lowered outlooks have been met with unforgiving stock price volatility.

Real dividend growth continues to be robust, but the rate of growth overall is receding in the face of higher rates. The job market remains tight and in some sectors that bore the brunt of COVID-19, workers have left, and replacement of their skills has become very difficult.

Financial services is a different story. The frothy compensation that became customary with cheap money is deflating. Layoffs are emerging and bonus compensation is under pressure in a move to balance cost structures with less hospitable financial conditions.

THE ECONOMY

Global economic activity continues to soften under the weight of central bank tightening. The demand reversion that began with COVID 19 continues to reinforce both wage and price pressures that remain stubborn and elevated as second and third waves of inflation emerge. With the volatile components of core inflation, i.e. food, housing, and energy removed, the remaining components are persistent at 4% or higher. This scenario then begs the question: does the continued reliance on monetary policy without significant fiscal support reduce the efficacy of the interest rate solution in taming inflation? Does it create additional liquidity risks that are not priced in at present?

Declining economic activity exists in most regions of the world, some of which will move on to recession while others may slow and avoid the technical definition of recession, which requires two consecutive quarters of economic contraction. Although the general trajectory of growth is negative, specific GDP forecasts are fragile and potentially counter-productive until the impact of higher interest rates is clearer.

Year to date GDP growth is tracking at 2%, owing in large part to resilient consumer spending. This spending, which during the pandemic focused on goods, has swung sharply to services. Persistent tightness in the labor market and residual pandemic era savings have provided the necessary financial support for consumers to satisfy their pent up demand. The University of Michigan’s consumer sentiment survey shows robustness, with the June 2023 survey coming in at 64.4%, substantially higher than the 50.0% reported for June of 2022.

Inflation expectations play a role in determining actual inflation. We note that although consumer expectations of near term inflation have receded from a year ago, longer term expectations remain above 3%. The long view is that 40% of consumers have experienced a reduction in their standard of living and only 16.5% expect their incomes to grow faster than inflation.

In spite of this year’s decline in prices of energy and hard commodities, we should not be lulled into a sense of believing that volatility has ended. To the contrary, production continues to decline in the face of sharply higher long-term demand. Further, capital expenditures for future capacity have been declining and the costs of renewed investment have continued to escalate. These factors present a backdrop against which significant price inflation in these essential materials could occur.

After declining in the fourth quarter of 2022, the US dollar has been generally flat this year. Investors’ acceptance of the Federal Reserve’s resolve to keep rates higher for longer likely has helped the dollar find its footing temporarily. It remains to be seen if this level can be sustained.

INVESTMENT STRATEGY

Our approach to fixed income remains cautious. The inverted yield curve and the Federal Reserve’s resolve in the inflation battle lead us to maintain short duration bond allocations. The lack of reward in credit spreads affirms our focus on high quality. This strategy provides liquidity, good current return and the flexibility to extend durations in an opportunistic fashion.

On the equity front, we reiterate comments in our first quarter report. The stocks of high quality companies are not immune to a litany of risks that are compounded by market and economic uncertainty. However, this can be viewed in a positive context - good entry points are created by difficult markets. We remain focused on companies with durable businesses, financial strength, and excellent management teams and the ability to generate strong cash flows. Companies with above average dividend growth are particularly desirable for their ability to protect and grow the purchasing power of our clients’ portfolios. Stand fast, stay liquid and act when market uncertainty favors the prepared mind.

SOME THOUGHTS ON INFLATION

Inflation remains a global challenge. Its roots and waves will vary by country due to differences in basic economic structures, whether capitalistic or collective.

In the US, our consumer driven economy is funded largely by wages, transfer payments and investment income. With the onset of COVID-19, inflation awoke from its ten-year long slumber of 2% or less by the convergence of demand-pull and massive supply chain disruptions of both consumer and industrial goods. As COVID began to abate, cost-push inflation became the not-so-transitory result of various distortions and dislocations of the pandemic and the ensuing response.

Central Bankers initially misread the strength of newly emergent inflation waves and referred to them as transitory adjustments. It was only after the storm of price increases went global, triggering record cost of living adjustments and fiscal deficits, that strong interest rate medicine was administered. This morphed into a complicated process where monetary policy makers had to deal with unwinding some ten years of quantitative easing with an eye on an enormous asset bubble that likely could not withstand the stress of rising interest rates.

Monetary authorities have had to contend with the fallout from liquidity contraction and reduced lending as interest rates moved from negative (highly accommodative) to restrictive territory while at the same time managing rapid realignment of exchange rates. The resilience of the US economy and the strength in the dollar made the US an exporter of inflation to most of Europe. Now, the US is importing inflation due to the recent decline in the value of the dollar.

In spite of all efforts to date, global inflation forecasts are still well above the aggregate inflation targets of 2.5% set by most central banks. At present, global inflation is forecast to clock in at 6.9% for 2023 with the prospect of receding to 4.5% in 2024, assuming no surprises in energy and commodity prices nor a meaningful rise in service inflation as labor markets remain tight. Central bankers’ mantra of higher for longer indicates the risk of inflation is viewed as the greater of the evils of recession or inflation.