3rd Quarter, 2025

China is the greatest long-term adversary ever faced by the U.S.

The Markets

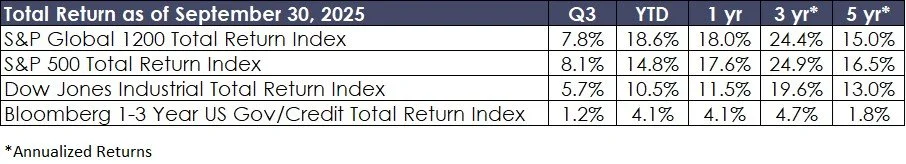

Equity markets pressed higher this quarter, with the S&P 500 rising 8.1%. Optimism has been fueled by expectations of an end to restrictive Federal Reserve policy, exuberance over rapid advances in artificial intelligence (AI), resilient consumer spending, and a broad appetite for risk assets.

Yet, while momentum has been positive, underlying challenges remain largely unheeded. The steady climb in the U.S. deficit, inflation that persists above target, eroding profit margins among smaller businesses, and slowing corporate investment amid political uncertainty all cast longer shadows than markets presently acknowledge. Confidence remains fickle, and volatility’s seeds continue to sprout just beneath the surface.

The Economy

Economic growth expectations have improved modestly, with 2025 GDP forecasts now at 1.6%, though well below the 2.8% achieved in 2024. The labor market shows growing strain—new hiring has slowed, job openings have plateaued, and unemployment now exceeds available openings. Weakness is most visible in the oil and gas sector, though it is broadening across industries.

Tariff policies, applied unevenly and inconsistently, risk weighing heavily on both domestic and global growth. Historically, aggressive tariffs have reduced investment, dampened growth, and fostered political unrest. The current path may prove no different.

Housing affordability remains deeply impaired. With mortgage rates anchored by upward pressure on long-term Treasury yields, relief for homebuyers appears distant. This imbalance is likely to grow in political significance as we approach the 2026 midterm elections.

Globally, central banks appear to have paused their tightening cycles. European rates have settled, Japan is nudging long rates higher while selling foreign assets, and the U.S. dollar has weakened by 10% year-to-date as hedging activity accelerates. At the same time, central banks continue to add to gold holdings while reducing exposure to U.S. debt—a quiet but important rebalancing.

In Europe, rearmament spending has provided a firmer growth footing, with NATO members committing 3%+ of GDP toward defense. India sustains robust growth above 6%, while China struggles to balance domestic challenges with export ambitions. Japan continues to grow but at a slower pace, constrained by demographics.

The global impact of U.S. tariff uncertainty is not limited to economics—it is shifting alliances. Canada looks more to Europe, Europe increasingly toward China. The risk of unintended consequences is rising.

Investment Strategy

Strong equity market performance this year is largely underpinned by investor, and increasingly retail investor, euphoria around the potential for AI to be revolutionary technology. As with the growth of the internet in the late nineties, expectations are only limited by the imagination.

However, much like with the internet, the need for economic returns may hamper investor appetite to fund AI infrastructure spending before the dreams are realized in the short-term. The market moves in cycles, and the wave of the future is usually paired with undertow.

We can’t know what the countervailing forces will be to AI optimism, but history teaches us that they always exist.

As a result of this, we continue to favor attractively priced companies with durable business models, disciplined capital allocation, and the capacity to compound shareholder value over time. Equities remain the cornerstone of portfolios as they give investors the best opportunity for attractive real returns.

Bond markets remain a useful counterweight. Short-term rates are likely to continue declining, while a steeper yield curve favors moderate-duration fixed income portfolio positioning. Selectivity and discipline remain paramount across both equity and fixed income allocations.

U.S. vs. China

The rivalry between the U.S. and China is no longer hypothetical—it is strategic, structural, and intensifying. As Henry Kissinger observed, China represents the most formidable long-term rival the U.S. has ever faced. Two decades ago, U.S. GDP was twice that of China; today, China has narrowed or even reversed that ratio depending on measurement.

China’s authoritarian model affords it a long horizon, while U.S. policy is shaped by shifting electoral cycles. The geopolitical competition now spans nuclear capacity, naval force projection, and perhaps most critically, technological supremacy. AI, quantum computing, and robotics are at the center of this contest. China is deploying talent, capital, and state-driven coordination to accelerate its lead, particularly in robotics and applied household technology.

The stakes extend beyond economics. China’s ambitions for Taiwan, its growing alignment with Russia, Iran, and North Korea, and its rapid militarization raise the prospect of a more perilous second Cold War. The ability of the U.S. and its allies to counterbalance across multiple fronts will be tested.

Closing Thoughts

We remain long-term investors in a short-term world. Markets are buoyed by optimism, yet history reminds us that momentum alone is not a substitute for fundamentals. Rising debt levels, geopolitical realignment, and structural economic shifts all counsel caution.

Our approach is steady: emphasize quality, preserve flexibility, and allow time and compounding to work on our behalf. While the path forward is unlikely to be smooth, patience and discipline remain the most reliable guides for enduring and building wealth through uncertainty.