4th Quarter, 2025

China continues to hold an economic advantage in manufacturing and AI.

The Markets

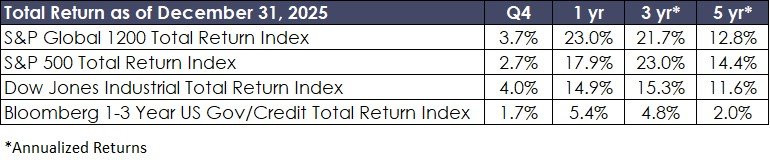

Global markets pressed higher through the fourth quarter, though periodic volatility reflected shifting investor sentiment. The year concluded with major central banks converging on policy rates, pushing the U.S. dollar to a decade-low against most G7 currencies following the latest Fed rate cut.

Equity valuations remained elevated. The S&P 500 closed the year trading at 22 times earnings, while its dividend yield compressed to 1.15%. Companies delivered respectable 6% dividend growth in 2025, though reduced economic visibility suggests a more modest 5% growth rate for 2026.

The dominant force propelling equities has been the rapid global advancement of artificial intelligence, with the United States and China locked in intense competition for technological supremacy. While AI-related stocks led for most of 2025, the final four months witnessed welcome broadening as financial, industrial and pharmaceutical sectors surged ahead.

In fixed income, corporations issued substantial new debt while the Treasury increased reliance on short-term bills. The 10-year Treasury yield remains stubbornly above 4%, and 30-year mortgage rates have yet to break below 6%, signaling elevated stress within the $30 trillion Treasury market. This reinforces our cautious stance and preference for shorter-duration exposure.

The Economy

Second and third quarter GDP figures demonstrate American economic resilience and underscore that businesses remain committed to growth. With unemployment at 4.4% and inflation persistent at 2.8%, the Federal Reserve faces the delicate task of transitioning to accommodative policy without compromising its inflation-fighting credibility.

Beneath these headlines, however, we detect growing frustration among significant segments of the population. Small businesses, the backbone of our economy and critical supply chain links, find themselves squeezed by tariff pressures and constrained credit. Unable to exercise pricing power with larger customers and reluctant to adjust workforces, they share their employees' struggles with widening affordability gaps. Consumer confidence has plateaued around 54 as income growth lags living costs. Recent special elections have seen surprising partisan shifts, signaling voter dissatisfaction with the economic stewardship of the current administration.

Retail spending reflects these diverging realities: lower-income households concentrate on necessities while affluent consumers pursue luxury goods. As savings deplete, evidence suggests wealthy households increasingly leverage surging margin debt to finance upscale purchases.

For 2026, we anticipate moderate GDP growth with potential fiscal and monetary policy volatility driven by pending Federal Reserve governance changes, Supreme Court decisions on Executive Branch authority and a federal deficit expanding to 6-7% of GDP.

Internationally, G20 growth should recover as accommodative central bank policies take hold. In Europe, the transition from defense contracts to production will boost profits and incomes. Meanwhile, trade patterns are shifting dramatically, with Canada pivoting toward European and Asian partnerships while China fills the commercial vacuum left by U.S. retrenchment.

Investment Strategy

The tension between optimism over technological advancements and increasing social and geopolitical unease has been the backdrop that investing markets have been grappling with for some time now. Fear, greed, irrationality and herd behaviors have all taken turns driving market returns over the past few years. These near-term sentiment shifts are sometimes referred to as “animal spirits”.

While these emotions are felt more acutely in the present, it’s important to remember that they are always with us and they can shift quickly. Succumbing to the spirits is the antithesis of long-term investing as it is based on emotion rather than the fundamentals of an investment.

Against this backdrop, we believe that the prudent course of action is to consider what the purpose of the capital is and determine an appropriate allocation to meet the purpose, specifically taking into consideration income requirements throughout the year ahead. Prudent management means ensuring sufficient liquidity to meet financial needs without forced selling during market dislocations.

Fixed income plays an important role in providing that flexibility. We currently do not feel that corporate bond spreads properly compensate for the risks involved with holding those issues. We feel similarly about longer duration bonds, of all asset classes. As a result, short duration U.S. Treasuries are most likely to be the cornerstone of client portfolios at present.

We remain committed to seeking investments that both compensate us for inherent risks while providing the capability to generate meaningful fundamental appreciation and income that exceeds inflation over time.

The U.S.-China Quest for AI Dominance

We recently attended a lecture by Dr. George Yip, a leading authority on U.S.-China industrial policy competition. Dr. Yip illuminated China's "9-9-6" work ethic—9AM to 9PM workdays, six days a week—driving the nation's transition from imitation to innovation across frontier R&D, self-reliant technology infrastructure, data governance and global market penetration. China simultaneously works to overcome technology restrictions, data localization requirements, regulatory uncertainty and geopolitical trade pressures.

China's strategic playbook emphasizes achieving AI dominance over the United States. The nation has championed Liang Wenfeng, whose DeepSeek R1—a highly successful generative AI large language model released one year ago—represents a significant milestone. Notably, Wenfeng built his team on meritocratic principles rather than the punishing 9-9-6 model, reportedly developing his system for approximately $6 million—a fraction of the billions Silicon Valley firms are investing toward similar objectives.

As historian Niall Ferguson recently observed, there is no clear victory lap in sight for either competitor. Markets may not appreciate China’s economic advantage in manufacturing and AI. In any case, substantial capital remains at risk on both sides of this technological race.

In this environment, we believe successful outcomes will be driven not by reaction to near-term narratives, but by disciplined portfolio construction grounded in purpose, liquidity and appropriate risk compensation. Our approach remains deliberate and fundamentals-driven: maintaining flexibility, avoiding unrewarded risks and allocating capital where long-term return potential justifies uncertainty. While markets will continue to be shaped by powerful technological, economic and geopolitical forces, we remain focused on prudent stewardship of client capital—adapting thoughtfully as conditions evolve and remaining firmly aligned with each client’s long-term objectives.